Details on Zai's user verification process.

Overview

User verification is a process through which Zai collects and managed information on users that we send money to. Zai is required to collect information on users in line with regulators and third parties, the information we collect helps Zai prevent fraud and meet Anti-Money Laundering requirements.

Zai conducts regular checks on pay-out users (people you are sending money to) and the following information should help you understand how this works, as well as what your obligations are.

Required Information

In order for Zai to meet its obligations, we require you to pass us certain information about users that you are using your platform. Details on what information Zai requires can be found here.

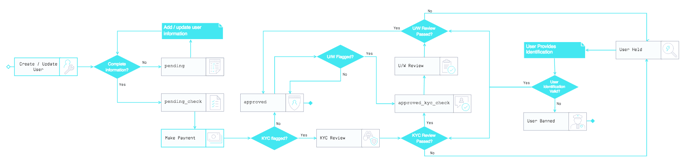

User verification workflow

A user on your platform will go through the following states:

Key:

Verification States

pending

A user in pending state has not submitted the complete required information for verification. See Fraud prevention for information we require for verification, then update the user information accordingly.

pending_check

A user in a pending_check state has submitted all of the required user verification information but has not yet been reviewed by Zai. A user will not enter the state of pending_check until that user's digital wallet has a positive balance.

When a user’s information is flagged for verification, we review the user’s profile and account to see that the information that was provided to us is accurate, consistent, and sensible.

If a user’s information passes the user verification review, the verification state transitions to approved_kyc_check. Otherwise, we may hold the user to verify the information that they provided on your platform. See the section below on held states to understand what happens when a user fails user verification review.

On the other hand, a user who is not flagged for user verification review is treated in good standing and enters the approved state.

approved_kyc_check

A user in approved_kyc_check has passed user verification review but has to undergo an underwriting (U/W) review to assess their level of prepayment risk.

If a user passes underwriting review, the verification state transitions to approved. Otherwise, we hold the user to verify the information that he or she provided on your platform. See the section below on held states to understand what happens when a user fails an underwriting review.

Note that even users in an approved state can revert to this state and undergo underwriting review to satisfy our risk appetite. Please note that we do not disclose our risk classifiers to ensure your platform’s security and integrity.

approved

A user in an approved state is considered in good standing and can receive payments normally on your platform.

To facilitate smooth testing workflows on pre-live, you can use the Verify User API call to transition a user to the approved state. Note that this call will only work on our pre-live environment. The user verification workflow holds for all users in production.

Held states

A user may be held when they fail the user verification or underwriting review. This means that the user is suspected of submitting dubious or false information on your platform. When a user is held, we request the user to provide identification to support the information they provided on the platform. Our team then scrutinises the information provided to assess whether or not the user is genuine.

Users held due to failed user verification or underwriting review retain the verification_state they last had, which is pending_check or approved_kyc_check. Meanwhile, the held_state becomes true.

Note that users can be held due to other reasons, which may be for their protection. For example, a user who has been a victim of an account takeover due to a phishing scam may be held to secure their account and credentials. For these instances, the user is held until we are sure that he or she has regained control of the account.

Continuous review

As user verification and underwriting are ongoing processes, all users undergo continuous review and can revert to prior verification states if they are flagged.

The user verification process also renews every 12 months, or when a user updates their information. If any of your user’s basic information changes, we review the user again following the user verification workflow.

We may also renew the user verification process for a user at the request of our merchant bank.

More information

For more information on user verification and Zai, refer to the following articles: